Simple And Quick Answer On How Retirement Is Calculated.

Introduction.

I get really annoyed by all the incorrect, and false garbage posted online. The purpose of this article is to provide a quick and clean answer and clarify which years are used to calculate your retirement benefits; based on the latest government document "Your Retirement Benefit: How It's Figured". I've provided a direct link to that document because it helps you calculate your benefits yourself. You can also do this online using the government's free estimator tool by creating an account with the government's SSA (Social Security Administration). If over time techies messes up that link or changes, then try this SSA Estimator link instead. Before you forget, bookmark this page (add it to your Favorites; Star it) for future reference.

Please note that I do not get paid to write these articles.

This article took about 4 hours to create.

You may also find the SSA Estimate Your Benefits useful.

Question and Answer

Main Question: Which years are used to calculate my retirement benefits?

Answer To Main Question: Your best individual 35 years you worked during your lifetime prior to retirement at age 66 (current Full Retirement Age for many is 66 years and 4 months). This does NOT mean the last 35 years and it means 35 individual years are selected and that those selected years are the best ones throughout your work lifetime.

Frequently asked questions (FAQs)

Q&A1

Isn't the last 10 years used to determine my retirement benefits?

My retirement payout is based on the last 5 years I worked?

Isn't the last 3 years used to determine my retirement benefits?

No, 35 years are used, and NOT the last 35 years, but the BEST 35 years during your LIFETIME of work.

Q&A2

Will there be any social security left by the time I retire?

Yes, from what I know. The reason for the answer of yes is that SS does have a surplus and generates funds from multiple sources (such as SS tax, and related bond returns), and when a gap occurs in 1.5 to 2 decades, I feel that government will make adjustments to fill the gap.

Q&A3

Wasn't it the last 30 years, and not 35?

I believe it use to be 30 years, but now it is definitely 35 years; please reference the gov doc in link given in the Introduction paragraph. This means you need to work more years to get the same payout. Seems unfair to me, but that is how it is for now.

Q&A4

Isn't the full retirement age 62?

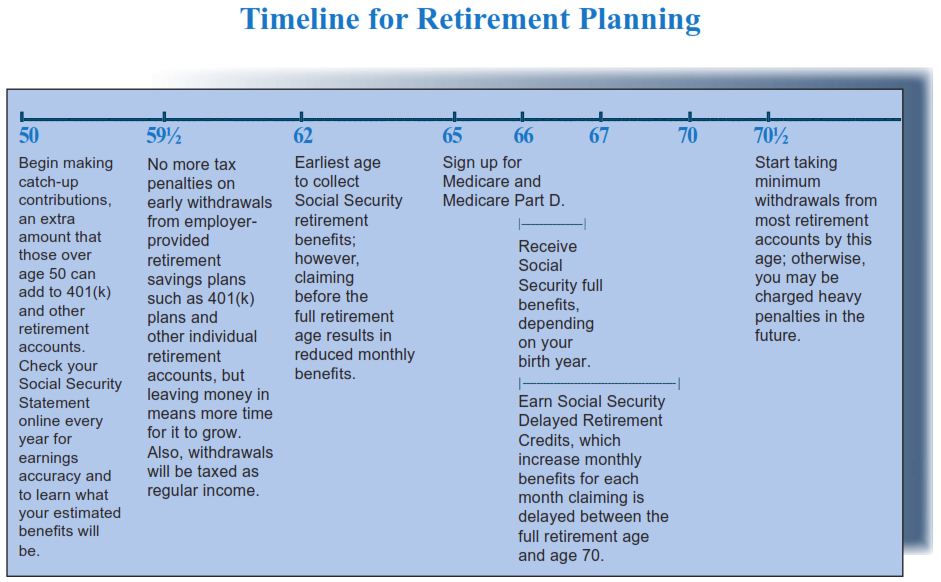

No, but you can begin getting early retirement at age 62, which causes less benefit payout to you (26.67% less monthly). Don't get confused between the phrase Full Retirement Age and Early Retirement. Depending on what year you were born, your Full Retirement age will vary. If you were born 1943 to 1954, then the Full Retirement Age is 66. For those born 1955 to 1959, the Full Retirement Age increases on a scale until it becomes 67 years for those born 1960 and after. An image shown below should help, and for your reference ti was gotten from the Retirement Toolkit.

Q&A5

Isn't the full retirement age 67?

Yes, and No. It depends on what year you were born. If you were born 1943 to 1954, then the Full Retirement Age is 66. For those born 1955 to 1959, the Full Retirement Age increases on a scale until it becomes 67 years for those born 1960 and after. An image shown below should help, and for your reference ti was gotten from the Retirement Toolkit.

(Click image to see larger copy)

Retirement Ages And Effects - From Toolkit doc.

Consider Contributing

- Article Contribution:

Consider submitting an article of your own to Tech Notes. I will create a sub-category for your article if needed. Guest articles are welcome! - Financial Contribution:

If you found this article or any Tech Notes article useful, and you'd like to make a financial contribution as a simple thanks (no fear, any small amount can be given), you can use the Paypal contribution button which is safe and does not require you to have a Paypal account to make a contribution to Tech Notes.

Feel Free To Leave A Good Comment. :)

Look around this site and it's menus, and you may find other useful articles.